FI- Sales Invoice Submission Test

Executed by

Accounts Executive - Receivable Finance Manager

Processes triggered from

- Student Admission - New Student Admission "(Variant)", Existing Student "(Variant)"

- Student Transfer

- Other Sales

- Stundent Refund - Credit Note

- Asset Managment - Selling an Asset

Navigation

Navigation 1 : Home > Accounting Module > Select Sales Invoice > Click on New Sales Invoice

Navigation 2 : Home > Go to Selling Module > Go to Sales Invoice

Steps

- Open the Sales Invoice.

- Select the invoice in Draft status.

- Verify the invoice based on its Invoice Type.

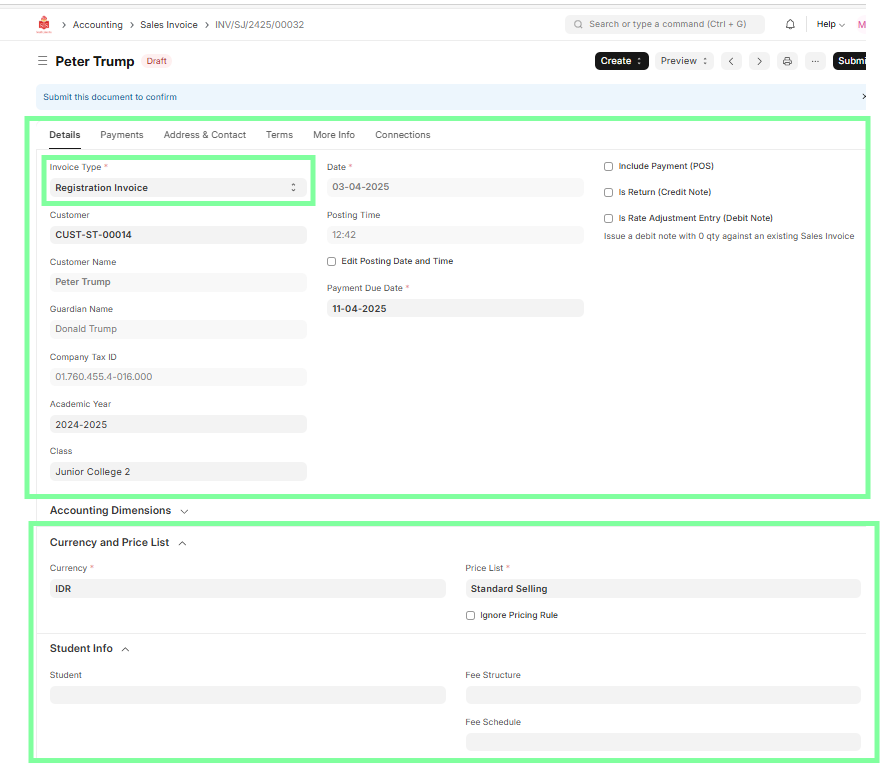

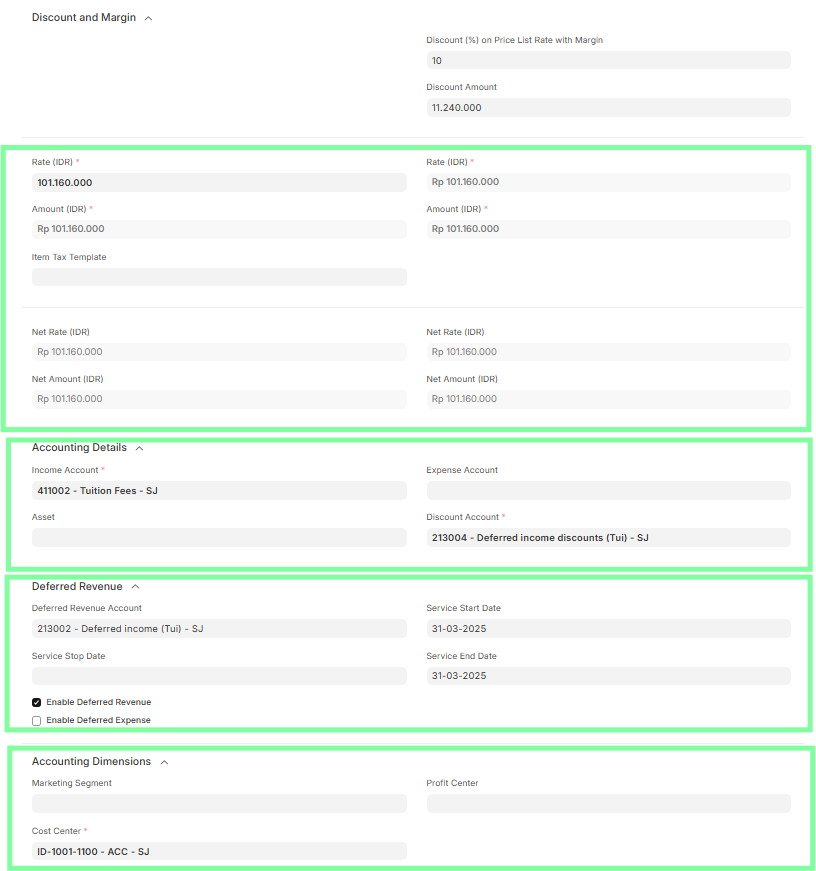

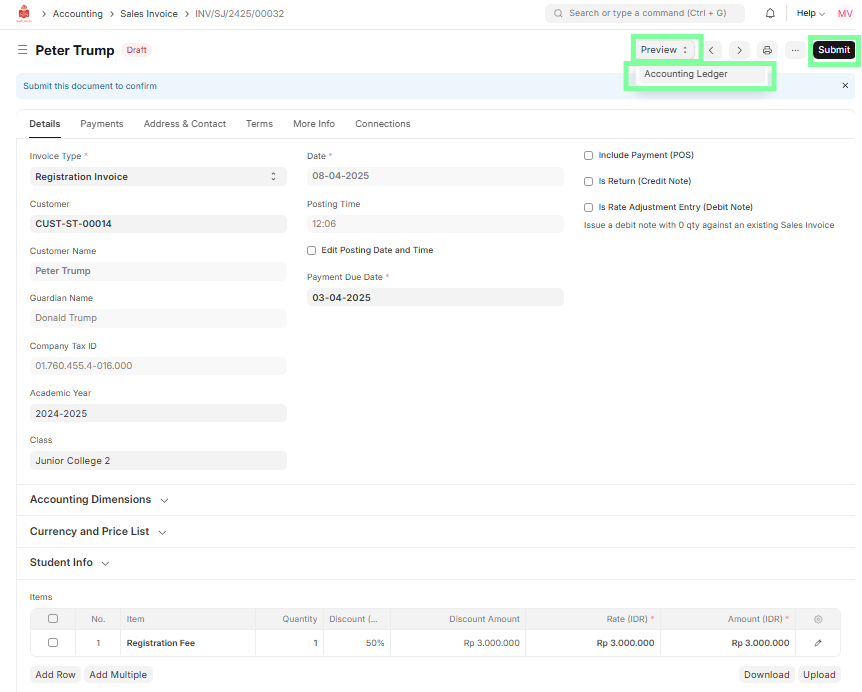

i) Registration Invoice

Header Section

- Invoice Type: Registration Invoice

- Customer Details (Customer, Student Name, Guardian Name)

- Academic Year

- Class

- Invoice Date and Posting Time

- Payment Due Date

- Profit Center and Cost Center

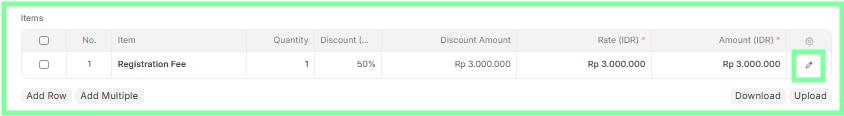

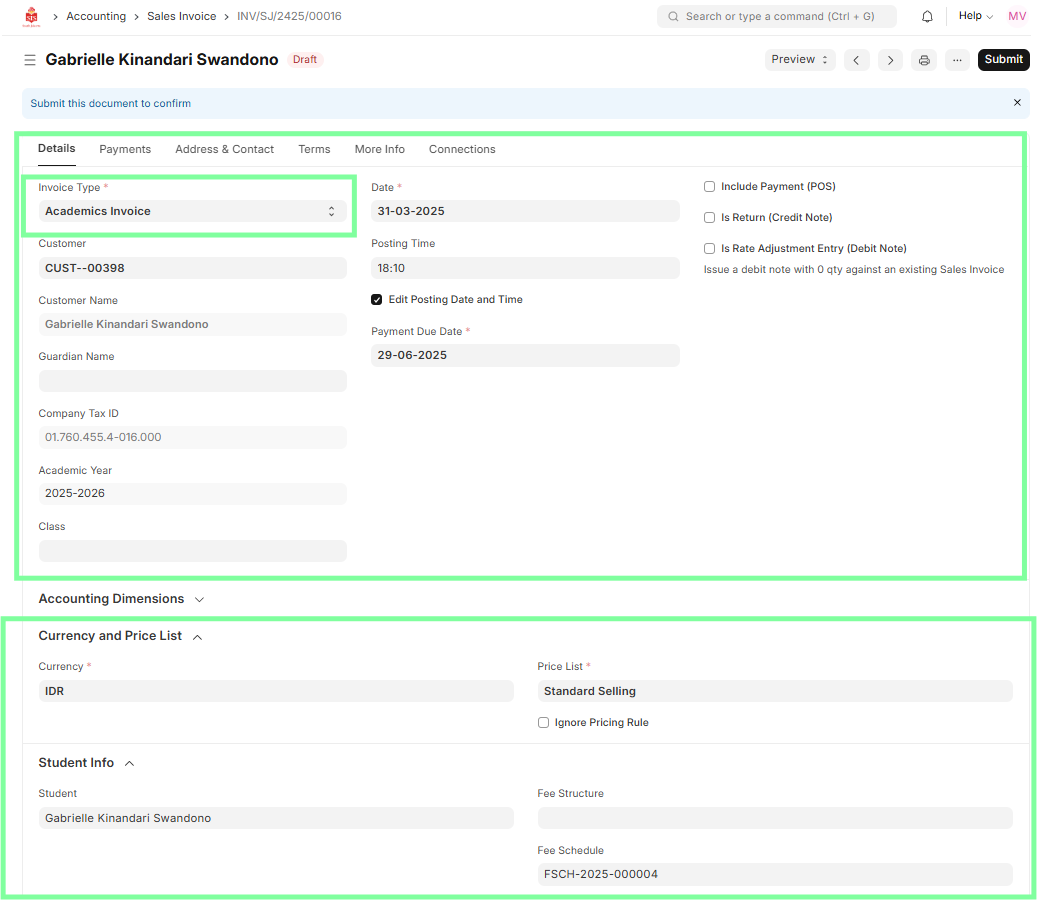

Line Item Section

- Check that the item is correct (e.g., Registration Fee)

- Verify Quantity and Discount % / Discount Amount, if applicable

- Ensure correct Income Account, Expense Account, and Discount Account

- Deferred Revenue should be disabled

- Ensure Profit Center and Cost Center fields are filled (Mandatory under Accounting Dimensions)

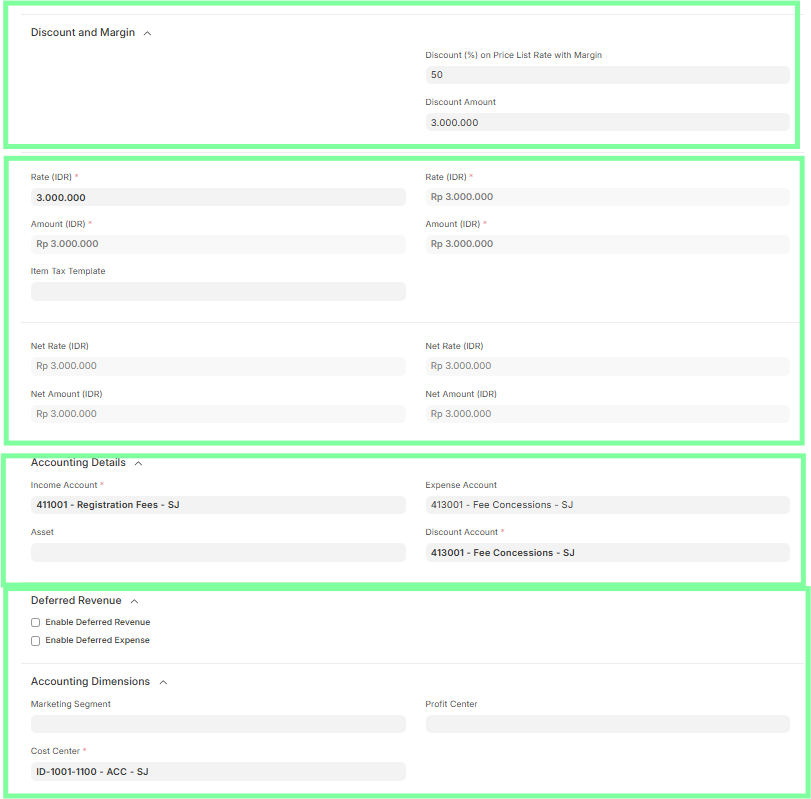

ii) Academic Invoice

Header Section

- Invoice Type: Academic Invoice

- Customer Details (Customer, Student Name, Guardian Name)

- Academic Year

- Class

- Invoice Date and Posting Time

- Payment Due Date

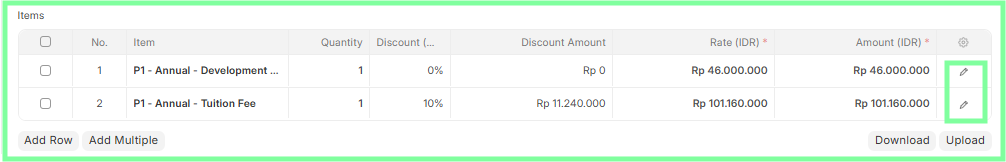

Line Item Section

- Check that the academic item is selected correctly

- Verify Quantity and Discount % / Discount Amount, if applicable

- Ensure correct Income Account, Expense Account, and Discount Account are mapped

- Deferred Revenue should be enabled & Enter Service Start Date and Service End Date

- Profit Center and Cost Center are mandatory

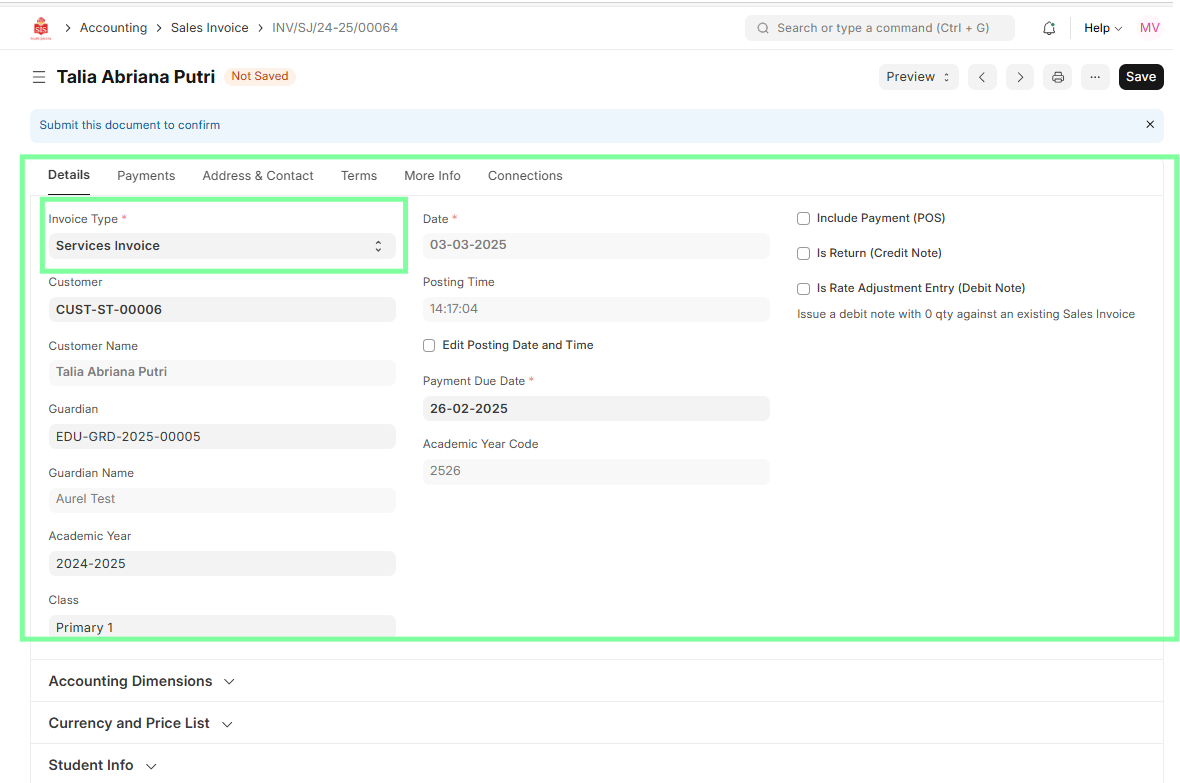

iii) Service Invoice

Header Section

- Invoice Type: Service Invoice

- Customer Details

- Academic Year (if applicable)

- Class (if applicable)

- Invoice Date and Posting Time

- Payment Due Date

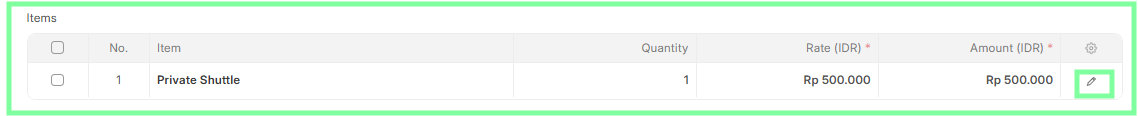

Line Item Section

- Check that the service item is correct

- Validate any Discount % / Amount, if applicable

- Ensure correct Income Account, Expense Account, and Discount Account are mapped

- Deferred Revenue should be enabled (only if applicable to the scenario)

- Enter Service Start Date and Service End Date if Deferred is active

- Profit Center and Cost Center are mandatory

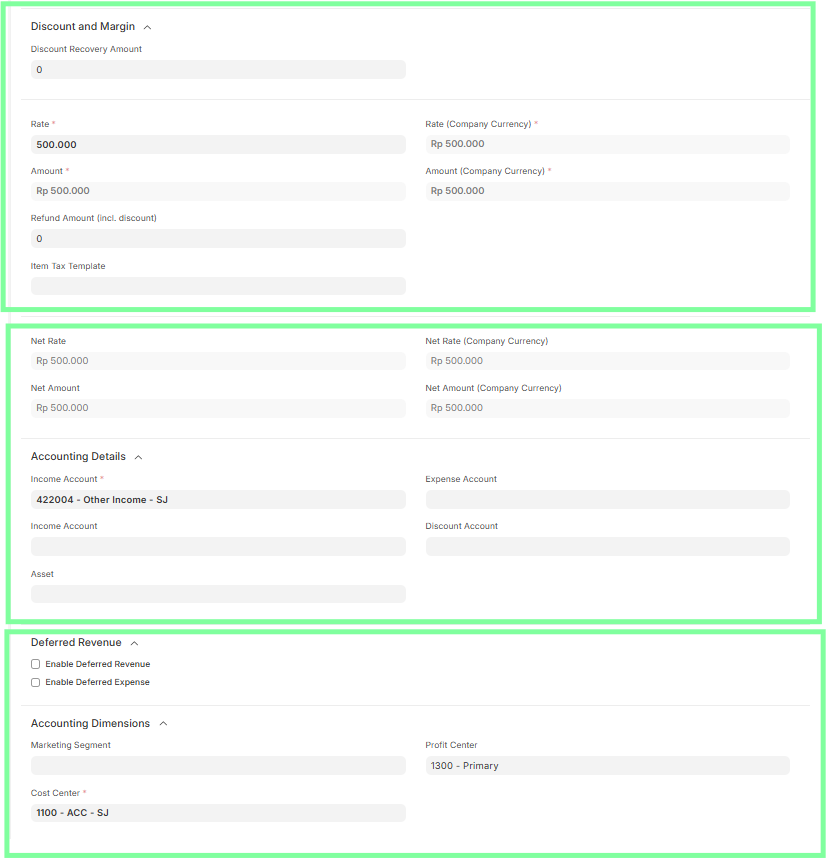

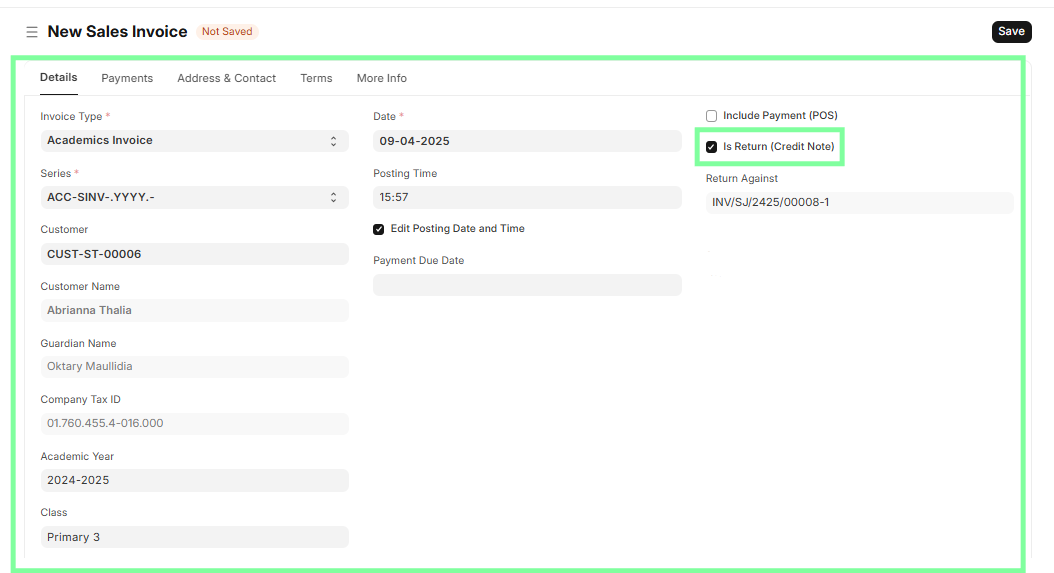

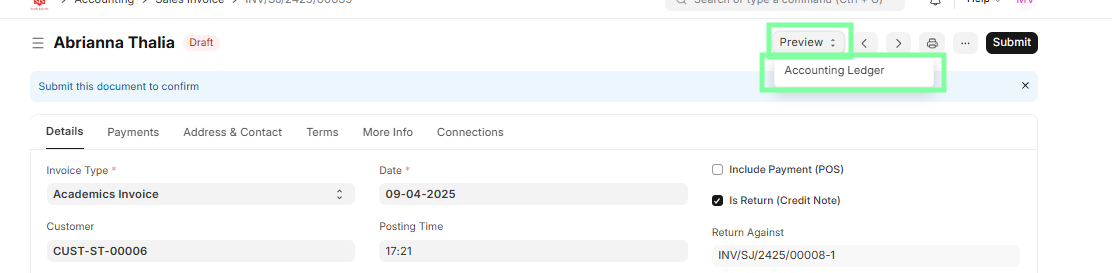

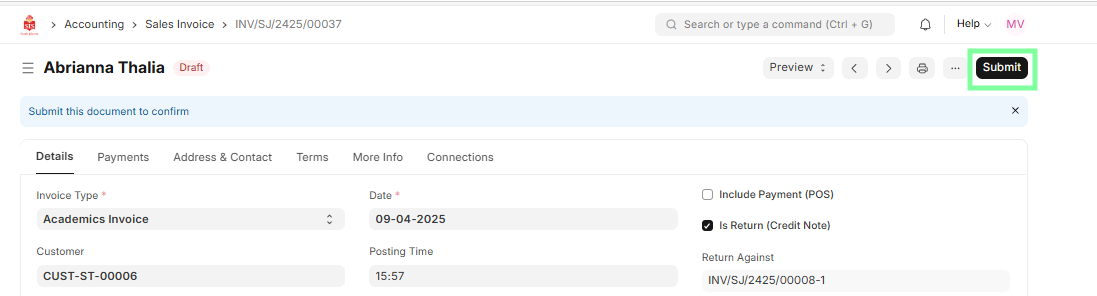

iv) Credit Note

Steps to Create a Credit Note:

- In the Sales Invoice, select the invoice for which a credit note needs to be created.

- Click on the Create button. A new Sales Invoice form will open with existing data.

Credit Note Processing:

- In Header Data: Verify the student details and make sure Is Return (Credit Note) is ticked.

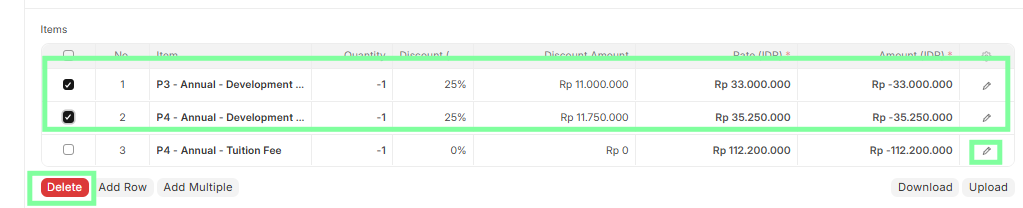

- In Line Item Data:

- Delete the Development Fee line.

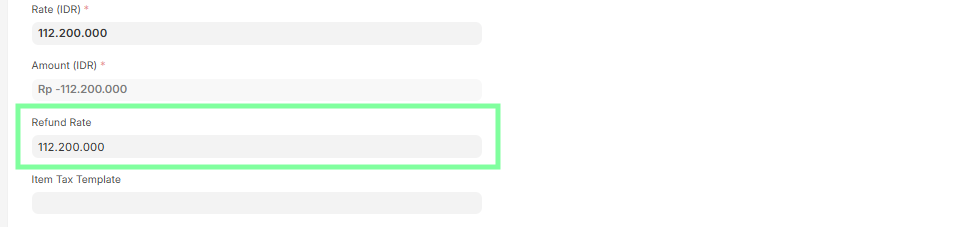

- Update the Refund Rate using the formula:

Unit Price - Revenue consumed amount = Refund Rate

Save the credit note to let the system calculate the net refund amount, considering any discount provided.

- The discount category & percentage will be fetched from the original Sales Invoice.

Note: Refund amount will not be calculated unless the Credit Note is saved and status is 'Draft'.

- The discount category & percentage will be fetched from the original Sales Invoice.

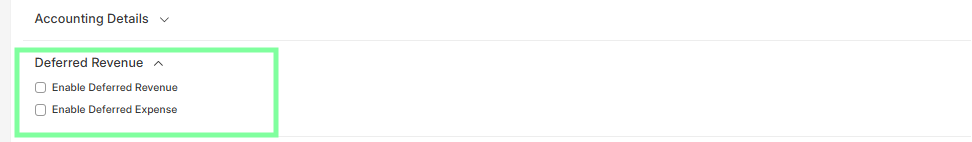

After saving:

- Ensure 'Enable Deferred Revenue' & 'Enable Deferred Expense' are unchecked.

Preview the Accounting Ledger.

Submit the Credit Note.

Post-Submission:

- A new entry will be created in the Sales Invoice with the status: "Return".

- The original invoice's status will be updated to: "Credit Note Issued".

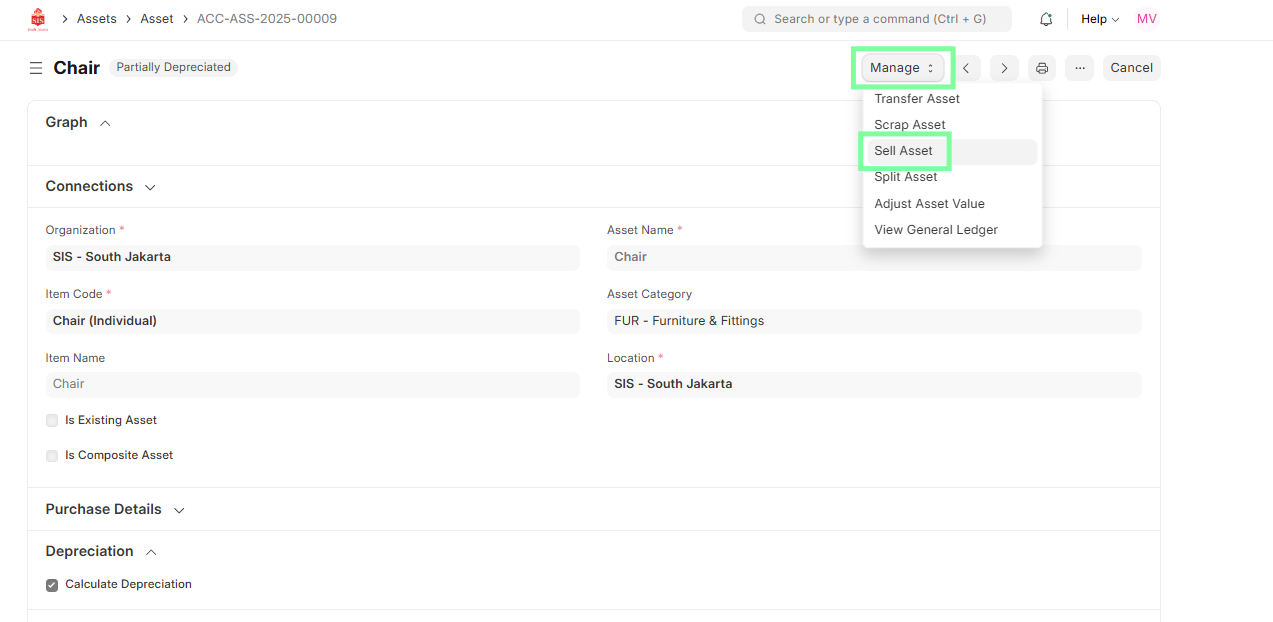

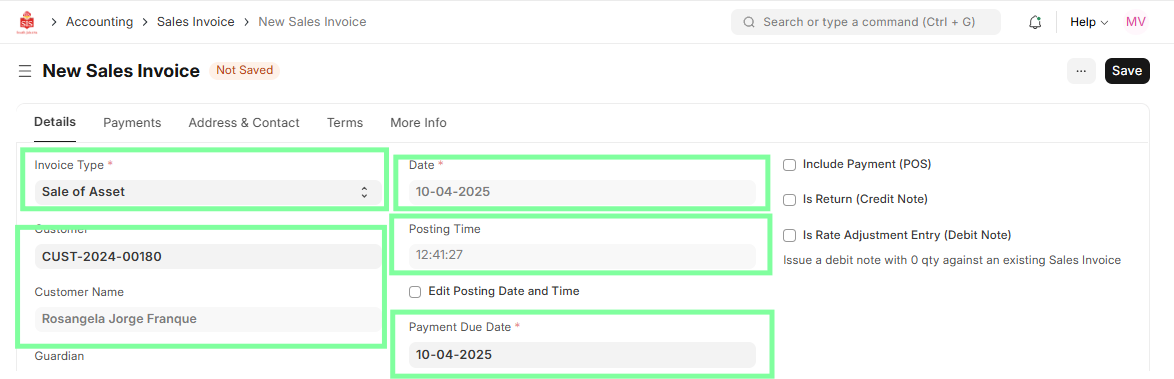

v) Selling an Asset

Steps to Generate Sales Invoice from Asset:

- Navigate to the Asset Module.

- Open the asset record that needs to be sold.

- Click on the “Sell Asset” button located in the top-right of the asset document.

- This will automatically generate a new Sales Invoice with pre-filled asset details.

Header Section

- Invoice Type: Sale of Asset

- Customer Details (Customer Name and Contact Information)

- Asset Name and Asset ID (automatically pulled from Asset record)

- Invoice Date, Posting Time, and Payment Due Date

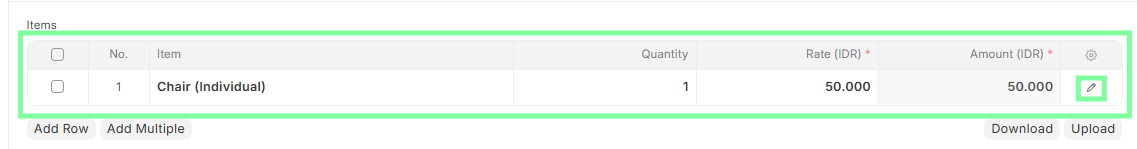

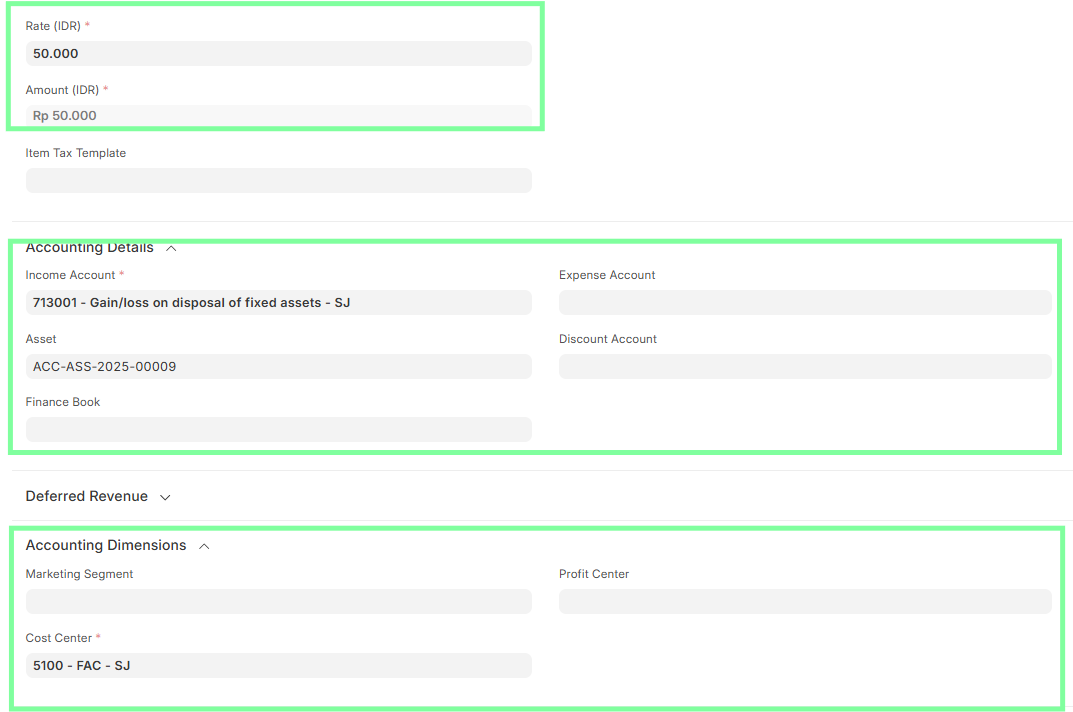

Line Item Section

- Asset Item appears as the line item

- Verify the Item Code, Asset Name, and Description

- Validate Selling Price / Amount

- Check Income Account also ensure Expense Account and Cost Center are mapped

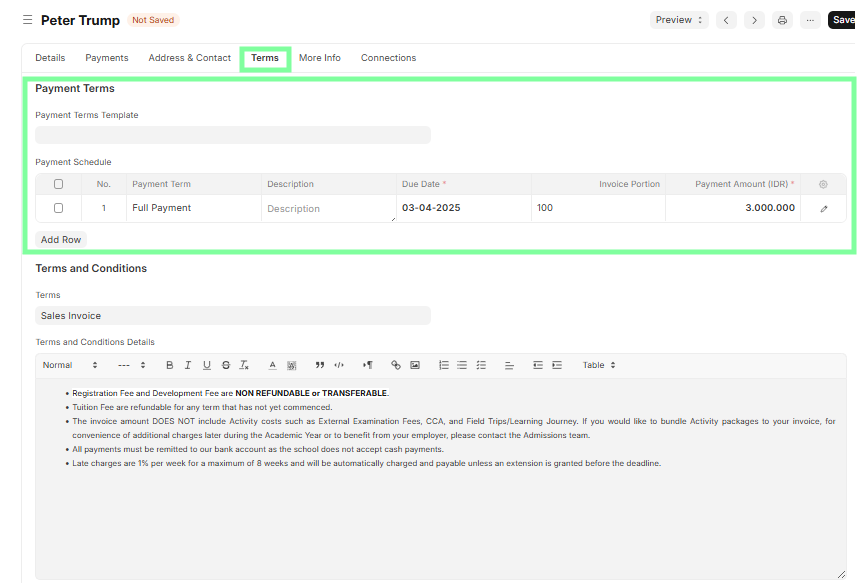

- Confirm Payment Terms are correctly set based on the agreement or fee structure.

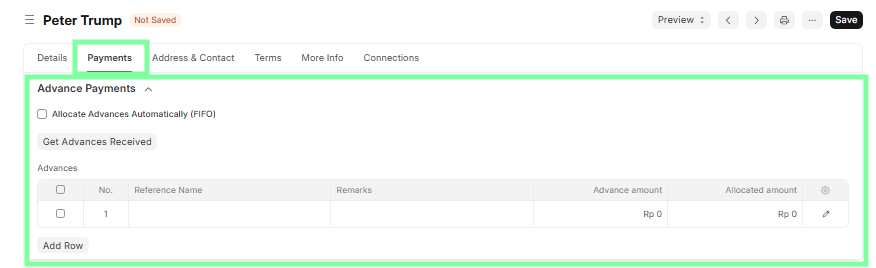

- Match the invoice against any advance/deposit received, if applicable (especially for admission deposits or prepayments).

10

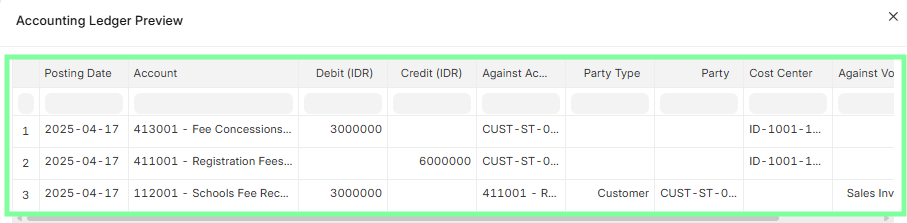

- Conduct a Final Review of the invoice and Preview the Accounting Ledger to ensure proper account mappings and totals.

- Submit the Sales Invoice and automatically generate the corresponding journal entry.

13