FI- Journal Entry Posting

This section includes the following journal entry posting processes:

- Monthly Posting of Journal Entry

- Payment Entry JV against Billing ID sent by the Tax Consultant

- Journal Entry Posting for Payroll Components

FI - Monthly Posting of Journal Entry

Executed by

Accounts Executive - Receivable

Processes Triggered From

- Student Admission – New Student Admission "(Variant)", Existing Student "(Variant)"

- Student Transfer

Navigation

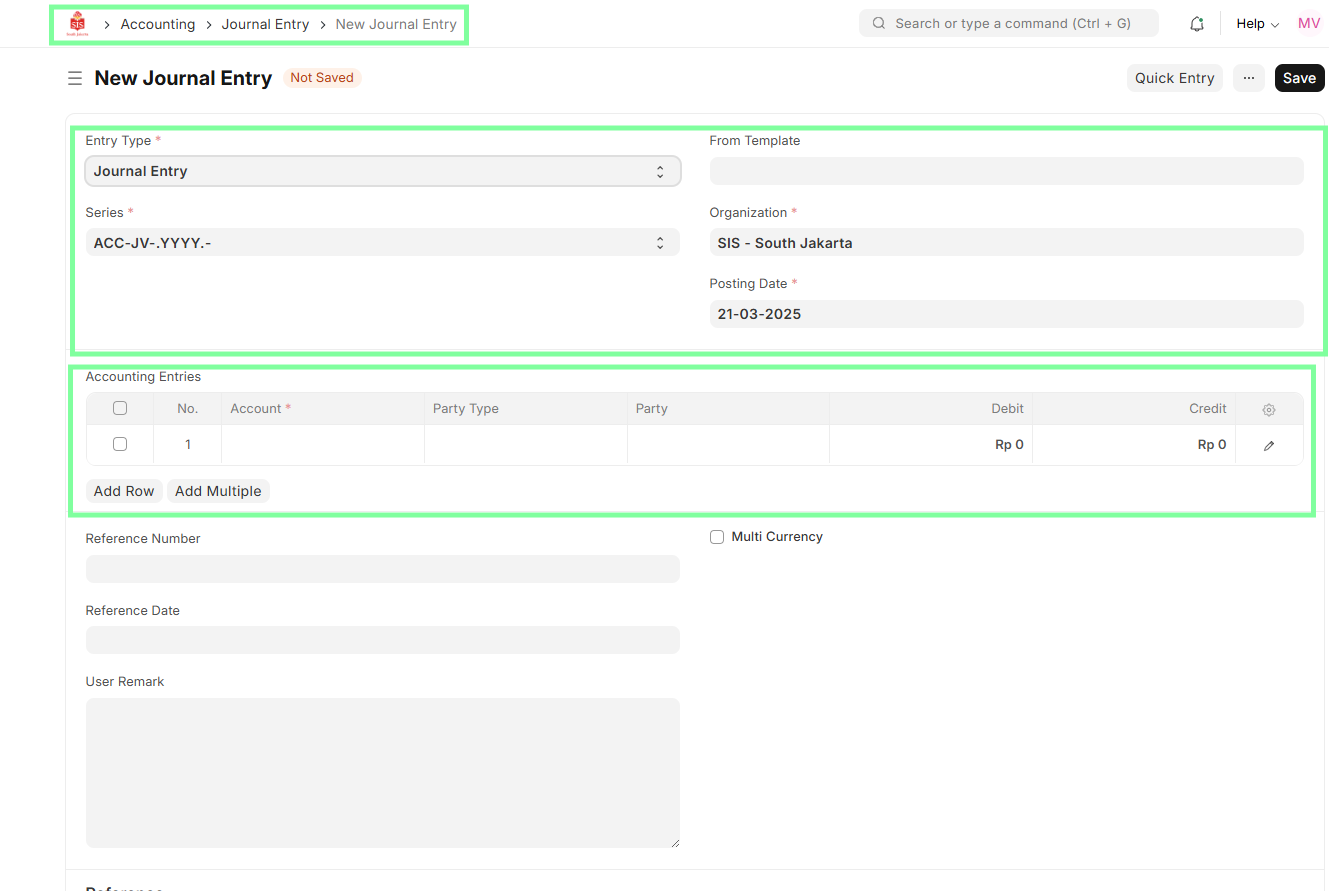

Navigation 1: Home > Accounting Module > Journal Entry

Navigation 2: Home > Sales Invoice > Connections > Journal Entry

Steps

- Navigate to Journal Entry.

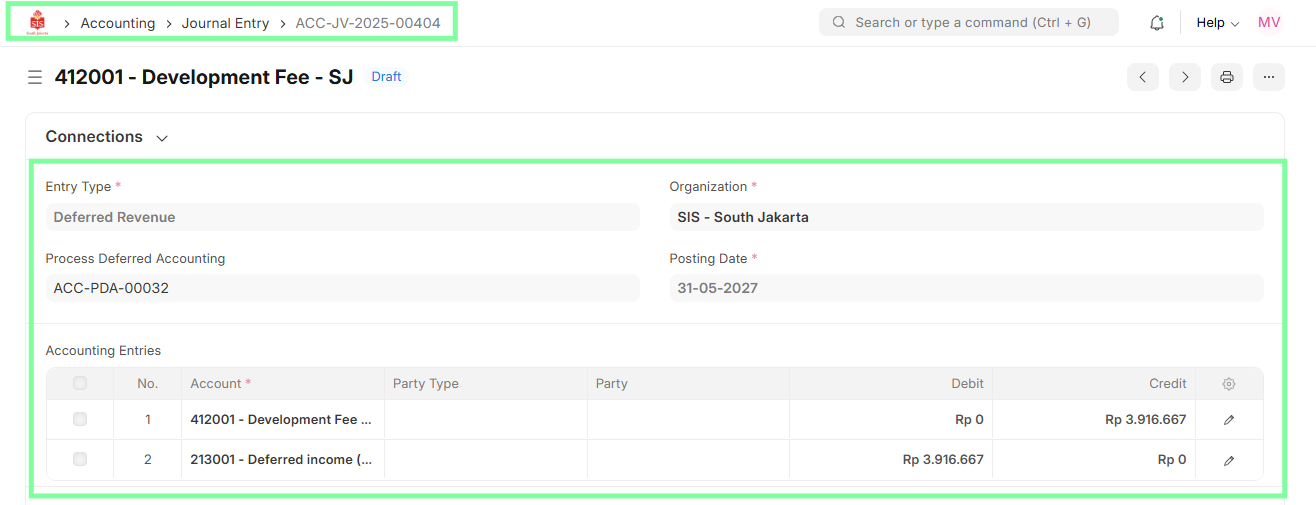

- Select Deferred Revenue & Expense Entry.

- Validate Entries and Period.

- Submit the Journal Entry.

Important Notes

- Submit journal entries monthly as per revenue and discount expenses that need to be realized for the particular month.

- NOTE: Future month journal entries are not allowed to be posted and will remain in draft mode.

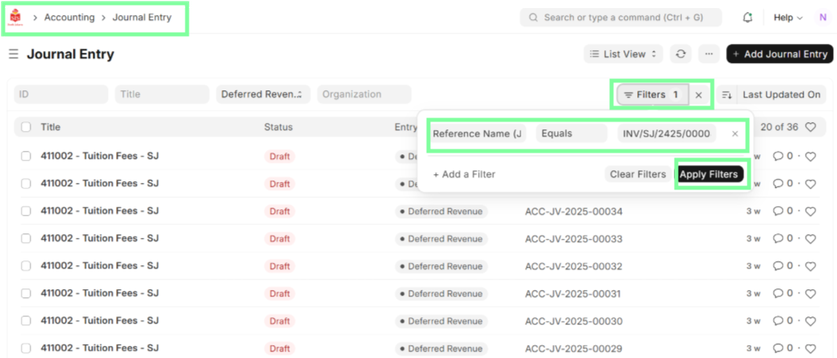

- For filtering invoice-specific journal entries, apply the following filters:

FI - Payment Entry JV Against Billing ID Sent by the Tax Consultant

Executed by

Finance Manager

Processes Triggered From

- Taxation – Domestic WHT "(Variant)"

- Taxation – WHT 26 "(Variant)"

Navigation

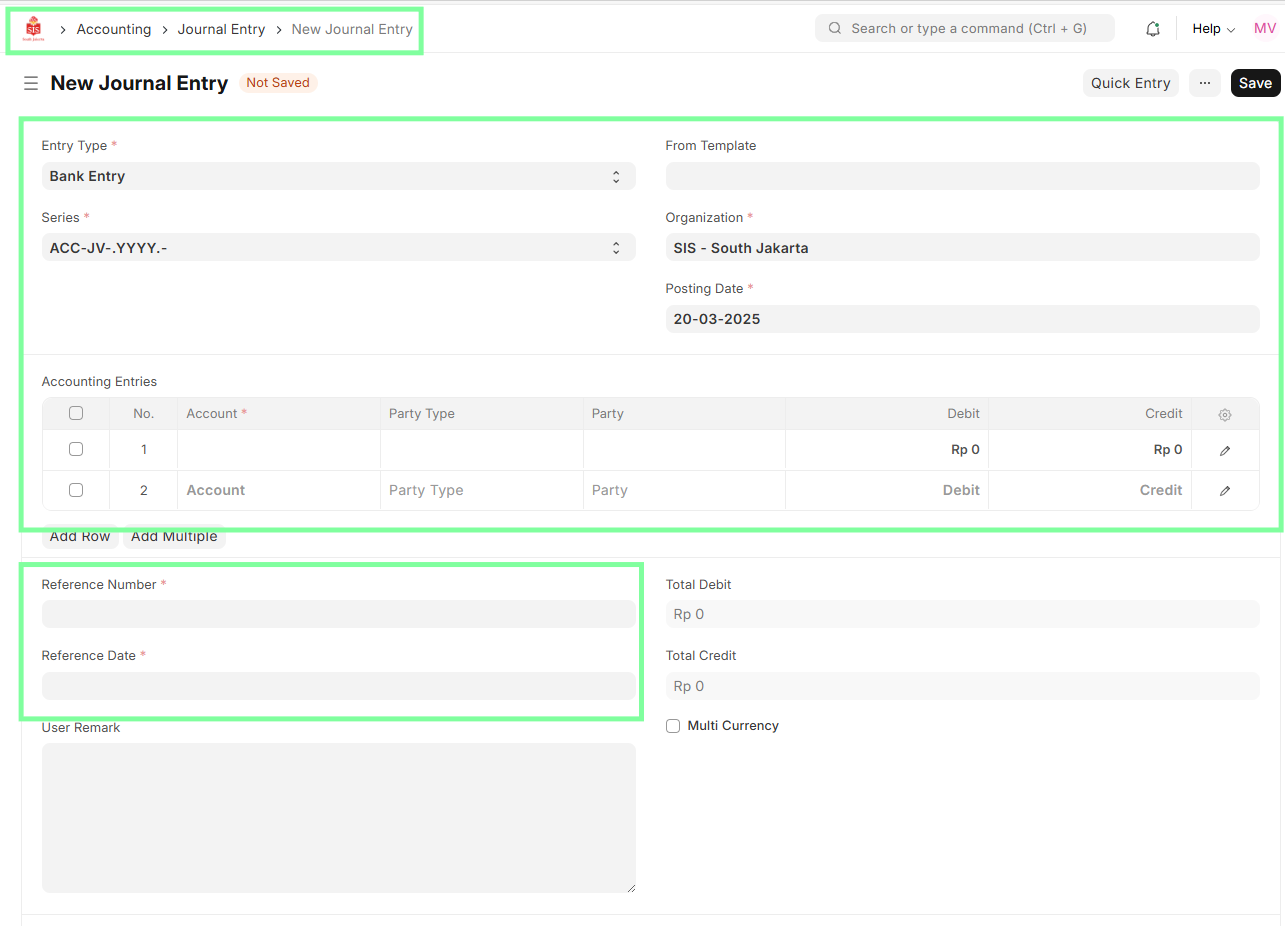

Home > Accounting > Journal Entry

Steps

- Navigate to Journal Entry.

- Select Entry Type (e.g., Bank Entry) & Posting Date.

- Select the Debit account (WHT Tax Account) & Credit account (Bank Account).

- Input details such as Debit & Credit Amount, Billing ID reference in the Reference Field.

- Save and Submit Journal Entry to clear the liability.

FI - Journal Entry Posting for Payroll Components

Executed by

Finance Business Partner

Processes Triggered From

- Payroll

Navigation

Home > Accounting > Journal Entry

Steps

- Finance Business Partner logs into ERPNext.

- Navigate to the Accounting module and open Journal Entry.

- Select "New Journal Entry" and enter payroll-related transactions.

- Specify ledger accounts, amounts, and references for accuracy.

- Save and submit journal entries to update the General Ledger.